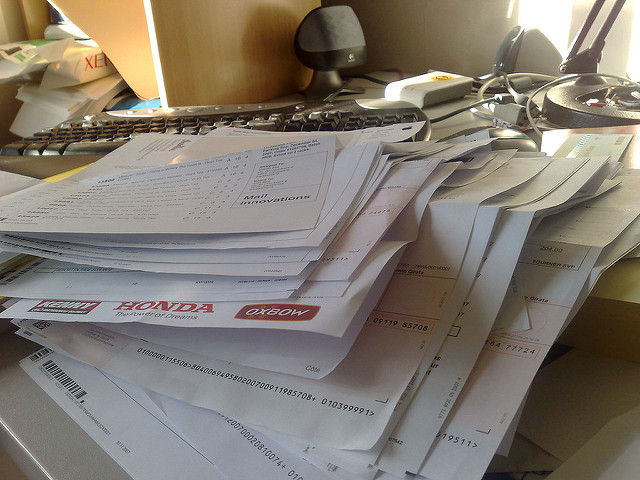

If your office is starting to overflow with documents, old records and other paperwork, it might be time to consider using a self storage unit for your business. Using an off-site storage facility for your documents, archives and records allows you to use your office space more efficiently and clear the clutter. Here are our top 5 tips to help organise your documents for self storage.

Only store what you need

Thoroughly declutter your paperwork before you start packing them away into boxes. Keep the documents you absolutely have to – this will depend on legislation and will vary depending on your business/industry.

Remove duplicates

It’s common for businesses to print the same document two, three or more times. Before packing all your documents into self storage, remove any duplicates. Recycle or dispose of them responsibly using a document shredder, or hire a lockable bin or secure bag. This will save you space and money.

Use archive boxes

Arch lever files might be more convenient for the office, but in self storage, it will just be a waste of space. Use archive boxes and dividers to sort your paperwork and save space. Fill the boxes fully, so they stack better and you can make the most of the vertical space in your storage unit.

Keep it organised

Label your boxes clearly, so it can be easily retrieved at a later date if required. Store any important documents you need to access regularly at the front of your unit – load them into your storage unit last.

We also recommend organising your boxes by year and keep similar paperwork together. Eg keep all invoices for 2015 together in the same box. This will save you time and hassle if you ever need to retrieve anything.

Have a document retention policy

Know what you need to store and how long you need to retain the paperwork. We’ve created a checklist below on some common documents you would normally keep.

Any documents that can be gotten rid of next year can be moved close to the front of the unit, so you can come back in a year’s time and move those boxes easily.

How long should you keep your documents for? Below are some examples.

Tax-related records – 5 years

- Most business records used for tax purposes must be kept for five years after the documents are prepared, obtained or the transaction that they refer to is completed, whichever occurs latest.

Financial records: 7 years

- This includes all the paperwork used to draw up a financial statement for your business.

Employment-related records: 7 years

- Any records relating to pay slips, employment status, hours worked, leave balances and superannuation payments must be kept for at least 7 years, to comply with Fair Work regulations.

Industry-specific records: varies

- This will vary depending on the industry. We recommend checking with your accountant, lawyer, business adviser, accountant, or other industry regulatory body.

Receipts for large purchases: indefinitely

- Keep the receipts in case you need proof of purchase.

Property and investment-related records: indefinitely

- If you renovate a business property, keep all the receipts as it may affect your capital gains tax. We recommend checking with your accountant or business adviser.

- If you dispose of a business property or stock, keep all records for at least seven years

Need self storage for your business? Speak to the storage experts at Rent a Space today by calling 02 8758 0000 for more information about our business storage solutions.